Discover the Hidden Value of Investment Vacation Properties

In today’s evolving real estate market, vacation properties stand out

In today’s evolving real estate market, vacation properties stand out as one of the most overlooked opportunities for investors. With the increasing demand for unique travel experiences, owning a vacation property has morphed into more than just a luxury — it’s a gateway to financial independence. Investors often view these properties through a limited lens, focusing solely on personal retreats. Yet, beneath the surface lies a significant wealth-building potential that combines lifestyle enhancement with a lucrative financial strategy.

Why Vacation Properties Are More Than Just Getaways

Vacation homes offer more than serene escapes. They serve as dual-purpose investments, bridging the gap between personal use and profitable rental ventures. A property that doubles as your holiday haven can also transform into a money-generating asset when you’re not using it. Think about it: why let a prime piece of real estate sit idle for most of the year when it could be working for you? Vacation properties can blend relaxation with financial opportunity, creating a dynamic asset class that exceeds traditional real estate expectations.

Understanding the Rise in Demand for Vacation Rentals

The shift toward experiential travel has caused an exponential rise in demand for vacation rentals. Travelers are no longer content with generic hotel rooms; they crave unique accommodations that offer home-like comforts with a touch of local flavor. This trend, accelerated by remote working options, has positioned vacation rentals as the go-to choice for extended stays, family vacations, and even business retreats. For investors, this surge in demand represents a timely opportunity to capitalize on the growing market for short-term rental properties.

How Investment Vacation Properties Generate Passive Income

One of the most appealing aspects of owning a vacation property is the ability to generate passive income. While you’re away or focusing on other ventures, your property continues to work for you, pulling in rental income month after month. This is especially true if the property is located in a sought-after tourist destination, where demand remains strong throughout the year. With minimal day-to-day involvement—often outsourced to property management companies—you can reap the financial rewards without being tied to the minutiae of daily operations.

The Dual Advantage: Personal Enjoyment and Financial Growth

A vacation property isn’t just a financial asset; it’s also a personal retreat. Imagine spending weekends or holidays in your own luxurious villa or beachside home, knowing that it doubles as a high-performing investment. This dual advantage is unique to vacation properties, offering investors the rare ability to enjoy their investment on a personal level while watching it appreciate in value and generate revenue over time. It’s an investment in both lifestyle and financial security.

What Defines a Prime Investment Vacation Property?

Not all vacation properties are created equal. A prime investment property is distinguished by several key factors: location, demand, amenities, and future growth potential. It’s not just about owning a picturesque cabin in the woods or a beachfront condo; the property must appeal to renters and provide a steady flow of income. Proximity to popular attractions, high-end amenities, and the ability to accommodate various guest profiles all contribute to what makes a vacation property truly profitable.

Choosing the Right Location for Maximum Returns

Location is the cornerstone of any successful real estate investment, and vacation properties are no exception. Whether it’s a tropical island retreat or a mountain lodge, the right location can significantly impact your rental income. Ideal locations often have strong tourism industries, year-round appeal, and proximity to major transportation hubs. Consider areas where tourism is thriving, but also weigh the long-term potential for property appreciation. A well-chosen location can generate consistent rental demand while ensuring long-term growth in property value.

How to Assess the Financial Viability of a Vacation Property

Before purchasing a vacation property, it’s crucial to assess its financial viability. This involves evaluating potential rental income, operating costs, and the long-term appreciation potential. Look at comparable properties in the area to gauge what you can reasonably expect in terms of occupancy rates and nightly rental prices. Additionally, factor in costs like maintenance, taxes, insurance, and property management fees. A thorough financial analysis will help you determine if the property will generate the desired return on investment.

Breaking Down the Costs: What You Need to Know Before Buying

Owning a vacation property comes with several upfront and ongoing costs that must be factored into your investment decision. Beyond the initial purchase price, consider closing costs, furnishing expenses, maintenance, utilities, property taxes, and insurance. Additionally, if you plan to rent the property, marketing costs and property management fees can eat into your profits. Having a clear understanding of these expenses will prevent unexpected surprises and ensure that your investment remains financially sound.

Financing Options for Investment Vacation Properties

Securing financing for a vacation property can be more complex than for a primary residence. Lenders often require larger down payments, higher credit scores, and proof of rental income potential. However, there are options available, from conventional mortgages to specialized loans for investment properties. Additionally, some investors leverage the equity in their primary residence to finance their vacation property purchase. It’s essential to explore various financing options and choose the one that aligns with your long-term investment goals.

Leveraging Tax Benefits and Deductions for Vacation Homes

Investment vacation properties come with tax benefits that can significantly reduce your overall costs. Many expenses associated with maintaining and operating a rental property, such as mortgage interest, property management fees, and repairs, can be tax-deductible. Additionally, depreciation can be used to offset taxable income from rental revenue. By understanding and utilizing these tax benefits, you can improve the financial performance of your vacation property investment.

Maximizing Rental Income with Smart Property Management

Effective property management is key to maximizing the rental income of your vacation property. Whether you choose to manage the property yourself or hire a professional management company, ensuring that the property is well-maintained, marketed, and available for renters is crucial. Offering convenient booking options, keeping the property clean and updated, and providing a seamless guest experience will lead to higher occupancy rates and better reviews, which in turn drive more bookings.

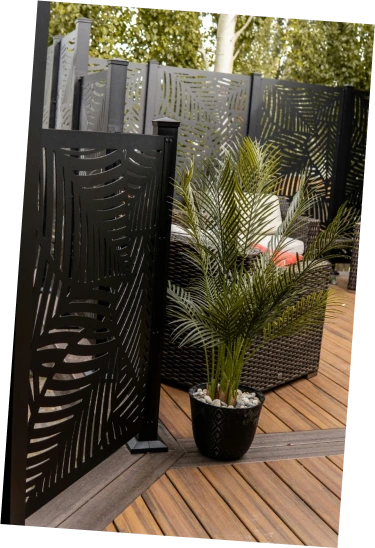

The Importance of High-Quality Amenities for Attracting Guests

Guests today expect more than just a place to sleep—they seek an experience. High-quality amenities such as Wi-Fi, a fully equipped kitchen, luxury linens, and entertainment systems can make your property stand out from the competition. Adding extras like hot tubs, outdoor fire pits, or game rooms can also enhance your property’s appeal and justify higher rental rates. The more you cater to the modern traveler’s expectations, the higher your chances of maintaining strong occupancy rates year-round.

Vacation Home or Vacation Rental? Weighing Your Options

One of the key decisions when investing in a vacation property is determining whether to use it solely for personal use or to rent it out to others. Both options have their benefits. If you choose to rent, the property can generate income and offset ownership costs. However, using the property primarily for personal vacations means more flexibility and fewer management hassles. Weigh the pros and cons to decide which route aligns best with your investment and lifestyle goals.

How to Navigate the Legal Aspects of Vacation Property Investment

Vacation property ownership comes with legal complexities, particularly when it comes to renting the property. Zoning laws, short-term rental regulations, and tax requirements vary by location, so it’s essential to understand the rules governing your property. Consulting with legal experts and working with experienced real estate agents can help ensure compliance and avoid potential legal pitfalls that could impact your investment returns.

Investment vacation properties offer a unique opportunity to combine personal enjoyment with financial gain. By understanding the factors that drive demand, carefully assessing financial viability, and navigating the legal landscape, you can position yourself for success in this lucrative market. Whether you’re seeking a personal retreat or a profitable investment, vacation properties can provide a rewarding and fulfilling experience.