Crowdfunding Real Estate: A New Era of Real Estate Investment

The digital era has revolutionized every industry, and real estate

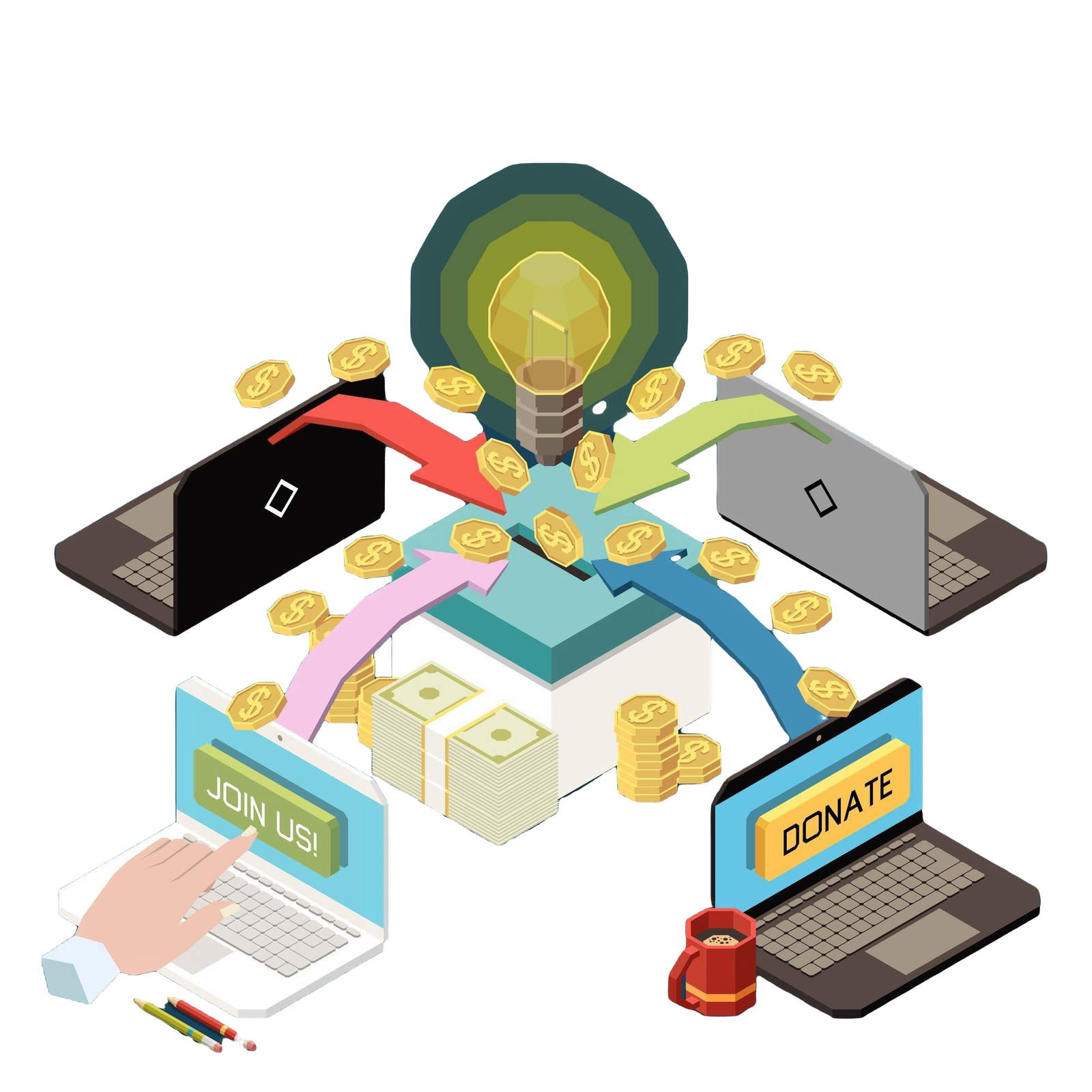

The digital era has revolutionized every industry, and real estate is no exception. Crowdfunding, a concept that started as a way for startups to raise capital, has now extended its reach into the real estate sector. Crowdfunding real estate is fundamentally changing how people invest, allowing individuals to pool their resources and collectively invest in properties once exclusive to high-net-worth individuals or institutional investors. This shift has opened the doors to a broader range of investors who seek lucrative real estate opportunities without the steep buy-in of traditional property ownership.

The Rise of Crowdfunding in Real Estate

Crowdfunding in real estate has taken root because of its ability to democratize an industry previously limited by high barriers to entry. As real estate prices soar, crowdfunding offers smaller investors a chance to tap into the property market. Fueled by advancements in technology, it has become easier than ever to browse properties, research projects, and invest—all through online platforms. This evolution is especially relevant in today’s fast-paced, digital society, where convenience and accessibility reign supreme.

Why Crowdfunding is Disrupting Traditional Real Estate Investment

Traditional real estate investment often requires significant capital, extensive property management knowledge, and time-intensive involvement. Crowdfunding disrupts these norms, providing a streamlined, hands-off approach that appeals to investors seeking convenience and reduced liability. By lowering the entry barrier, it attracts investors from various backgrounds, shifting power away from exclusive investment circles and allowing everyday individuals to gain a foothold in real estate.

Who Should Consider Crowdfunding Real Estate?

Crowdfunding real estate is ideal for investors looking for passive income, diversification, and those who wish to start with smaller investments. Those with limited real estate knowledge or time to manage properties will also find crowdfunding appealing due to the professional oversight provided by platforms. Ultimately, individuals looking to diversify their portfolios with tangible assets—without the hassle of property management—stand to benefit significantly from this investment model.

What is Crowdfunding in Real Estate?

Real estate crowdfunding is a collective investment approach where multiple investors pool their resources to fund real estate projects. Through online platforms, investors gain access to a variety of properties and investment types, ranging from residential to commercial and even mixed-use developments. Each investor owns a fractional share of the property, and any profits are distributed proportionally.

How Does Real Estate Crowdfunding Work?

Investors select a property or portfolio that aligns with their goals, contribute a specified amount, and earn a portion of the returns generated. Platforms typically manage the property, ensuring that investors receive passive income while the management and maintenance responsibilities are handled by professionals. Returns come from rental income, property appreciation, or other forms of generated cash flow.

Types of Crowdfunding Real Estate Models: Debt vs. Equity

Crowdfunding usually comes in two forms: debt-based and equity-based investments. In debt crowdfunding, investors act as lenders, funding real estate loans in exchange for fixed interest returns. Equity crowdfunding, however, allows investors to buy a share of the property itself, meaning they profit from property appreciation and rental income. Each model has unique risk-return profiles, catering to different investment preferences.

The Appeal of Crowdfunding Real Estate

Small Investments, Big Opportunities: Democratizing Real Estate

Crowdfunding allows investors to enter the real estate market with modest initial contributions, often as low as a few hundred dollars. This accessibility levels the playing field, inviting individuals from diverse financial backgrounds to invest.

Access to High-Value Properties with Low Initial Investment

Crowdfunding platforms provide access to high-value properties that individual investors typically could not afford on their own. From skyscrapers to multi-family apartment complexes, investors can diversify their portfolios by purchasing fractional shares in premium properties.

Reducing Risk with Diversified Property Portfolios

With crowdfunding, investors can easily diversify by spreading their capital across multiple projects or property types. This minimizes exposure to any single asset, reducing risk and allowing for a well-rounded portfolio.

Benefits of Crowdfunding Real Estate

Passive Income Potential: Earning Without Managing Properties

Crowdfunding offers a path to passive income, as properties are managed by professionals. Investors receive regular income distributions from rental earnings, freeing them from the demands of property upkeep.

Transparency and Control for Investors

Crowdfunding platforms emphasize transparency, offering investors detailed information about properties, expected returns, and ongoing performance metrics. Investors can select projects that align with their goals, exercising greater control over their choices.

Flexibility and Liquidity Compared to Traditional Real Estate

Crowdfunding platforms sometimes offer secondary markets, allowing investors to sell their shares if they need liquidity. This flexibility makes it an attractive option compared to traditional, less liquid real estate investments.

Risks Involved in Real Estate Crowdfunding

Potential Pitfalls and Common Risks for New Investors

Real estate crowdfunding, while accessible, involves risks. New investors may face unfamiliar financial terms or select high-risk properties without due diligence, potentially impacting returns.

Market Volatility: What You Need to Know

Like any investment, real estate crowdfunding is subject to market fluctuations. Economic downturns or shifts in property demand can affect property values and rental income, impacting returns.

Property Management Concerns and How to Address Them

Although property management is handled by professionals, poor management can lead to higher costs, lower returns, and delays. Investors should research a platform’s track record and management strategies.

Types of Properties Available Through Crowdfunding

Residential Properties: Apartments, Condos, and More

Residential properties remain popular in crowdfunding, offering stability and strong rental demand. Investors can access condos, apartment buildings, and other multi-family units.

Commercial Properties: Office Spaces and Retail Units

Commercial properties, including office buildings and retail spaces, provide higher income potential but may be subject to economic cycles. This sector suits those with a higher risk tolerance.

Unique Opportunities: Hotels, Warehouses, and Mixed-Use Properties

Crowdfunding platforms also offer unique property types such as hotels and mixed-use developments. These properties can diversify portfolios and offer lucrative income streams.

Legal and Regulatory Considerations

Understanding SEC Regulations for Crowdfunding Investments

Real estate crowdfunding is subject to regulations, especially for equity investments. The SEC regulates the types of investors allowed to participate and mandates transparency standards.

Accredited vs. Non-Accredited Investors: What It Means for You

Some crowdfunding opportunities are open only to accredited investors, while others are accessible to all. Understanding these distinctions helps investors choose suitable projects.

Tax Implications of Crowdfunding Real Estate

Crowdfunding investments generate taxable income, and investors should be aware of the tax implications, including income tax on rental earnings and capital gains taxes on appreciation.

The Process of Investing in Crowdfunding Real Estate

How to Begin: A Step-by-Step Guide to Getting Started

Starting with crowdfunding real estate involves selecting a platform, creating an account, reviewing properties, and making an initial investment.

Due Diligence: What to Check Before Investing

Due diligence is critical in crowdfunding. Investors should assess property location, projected returns, property management quality, and historical performance data.

How Returns Are Generated and Distributed

Returns are typically derived from rental income, property appreciation, or a combination of both, distributed at intervals determined by the platform.

Analyzing Potential Returns

How to Estimate ROI in Crowdfunding Real Estate

Estimating ROI involves analyzing rental income potential, property appreciation, and platform fees. Savvy investors use various tools and calculators to project potential earnings.

Comparing Crowdfunding to Traditional Real Estate Investment

Crowdfunding vs. REITs: Key Differences

REITs and crowdfunding both offer real estate exposure but differ in structure and returns. Crowdfunding allows for direct property ownership, while REITs involve share ownership.

Is Crowdfunding More Accessible than Direct Property Ownership?

Crowdfunding often requires lower capital than direct ownership and eliminates the need for property management, making it more accessible to everyday investors.

Crowdfunding has revolutionized the real estate industry, democratizing access to investment opportunities once reserved for the wealthy. By lowering barriers to entry and offering a diverse range of investment options, crowdfunding platforms empower individuals to participate in the growth of the real estate market. However, it’s essential to approach real estate crowdfunding with careful consideration, understanding the risks and rewards involved. By conducting thorough research, diversifying your portfolio, and partnering with reputable platforms like Incompass, you can harness the power of crowdfunding to achieve your financial goals.